The Unfunded Promise

Scene

Two senior staff. Both have been told for years there is “a path to equity”. One has already turned down a competitor offer based on that belief. The other has increased their hours and taken on partner-level responsibility. Nothing is written. No timeframes. No terms.

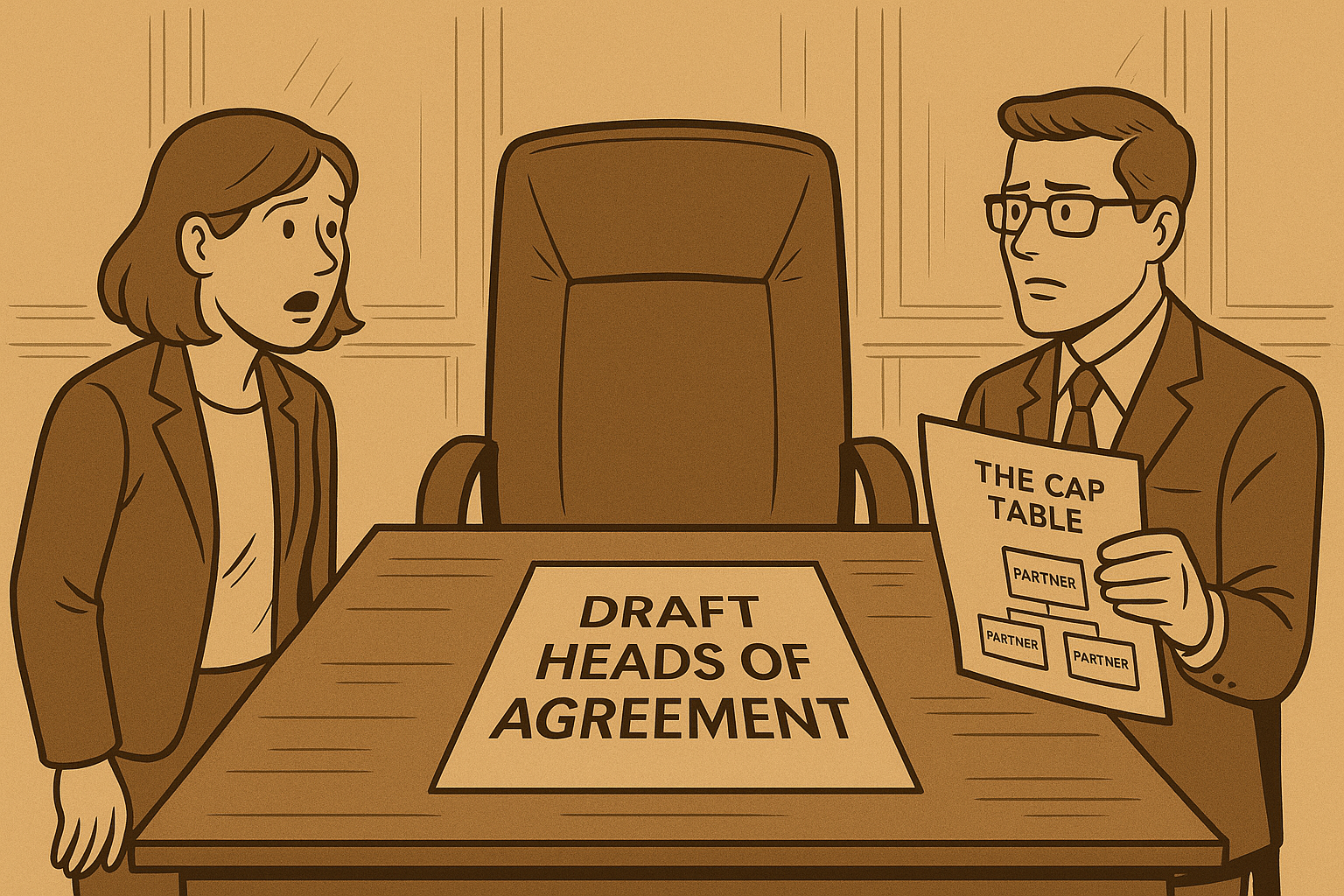

The firm starts sale discussions with a larger group. The draft heads of agreement list only the existing partners as vendors. The seniors see the document in the photocopier tray. One walks out of a client meeting mid-preparation. The other asks for “clarity” and is told “nothing is final yet”. The next fortnight is full of short emails, long silences, and sudden sick days.

Pattern: Implied Ownership

This is Implied Ownership.

Economic promises with no paper behind them.

Leaders talk about “future equity”, “sharing the upside”, or “bringing you in”. The language is casual. The effect is not. Senior staff reorganise their lives around a belief they will become owners. They accept below-market pay. They stay during difficult periods. They decline external offers.

On the partners’ side, these are intentions, not commitments. On the staff side, they become facts. Years later, when an event occurs (sale, merger, capital raise) those facts collide. Each side has a different memory of the same sentences. The dispute is framed as betrayal. Underneath, it is a documentation failure.

Analysis: How Implied Ownership Turns Toxic

The sequence is predictable.

Soft Promises.

Equity is mentioned in reviews and corridor chats. No criteria. No timing. No process. Expectations rise without record.

Accumulated Reliance.

The candidate starts acting like an owner. Extra hours. Informal leadership. Forgone pay. Partners read this as loyalty. The staff member reads it as proof of a deal.

Trigger Event.

A sale, valuation, or restructure exposes the cap table. The name is missing. Explanations sound technical. The staff member hears only that their years of reliance have no recognised value.

Reconstruction.

Emails and memories are trawled for “evidence”. Lawyers are consulted. Resignation letters are drafted. The firm risks both a key-person exit and a potential claim based on misleading conduct or reliance damages.

What began as an attempt to retain talent becomes an argument over who owns the uplift created.

Framework: Assess → Align → Act

Assess – From Hints to Inventory

Run a fast audit of every implied ownership signal:

List names, dates, and exact phrases used where possible. This is your Promise Register. Treat it as a risk document, not a wish list.

Align – From Vague Intent to Clear Criteria

With the register visible, the owners decide:

Convert sentiment into thresholds. Decide as owners before speaking to candidates. Do not crowdsource the criteria with staff. Alignment here is internal and commercial.

Act – From Conversation to Contract

For true candidates:

For those who will not receive equity:

Lock all of this into the firm’s governance pack so it survives leadership changes.

Tool: The Promise Register (One-Page Audit)

Create a simple table:

| Name | What was promised (exact words) | Who said it | When | Implied timing | Current intention | Next step |

Complete it with the leadership team in under an hour.

Any row where “what was promised” and “current intention” diverge is a live risk. Prioritise those conversations within 30 days, before any transaction or valuation event.

Why It Matters

Unfunded promises are delayed liabilities. They appear when the firm can least afford distraction: sale, merger, capital raise, or partner exit. Left alone, they convert high performers into critics, and routine deals into contested events. The legal claim is the final stage. The real damage is at the commercial layer—lost momentum, broken internal narratives, and a reputation for saying one thing and doing another.

If a client’s firm runs on implied ownership, introduce them to The Unravelling Map™ before those promises meet a transaction.