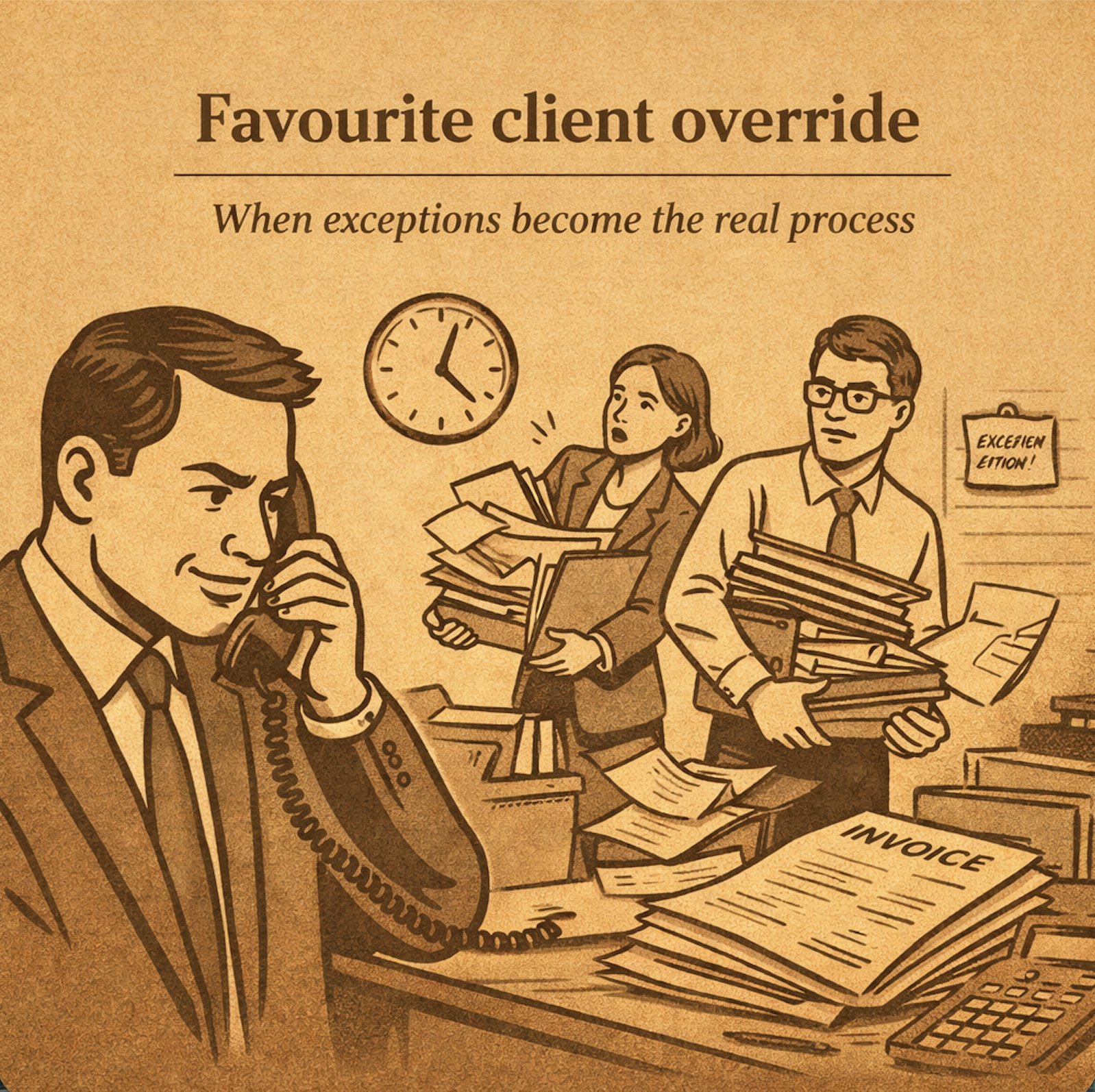

A small practice has a stable book of business. A few long-term clients provide a lot of revenue. One of them calls the founder directly.

They want the advice by Monday. They want “something sharp”. They do not want to sign anything new. They do not want to talk about fees until the end.

The founder agrees on the call. No one else hears the details. The team finds out when the founder forwards a three-line email: “Priority. Get it done.”

The practice manager asks for an updated scope note. The founder says they will handle it. Staff start anyway. Time recording becomes light because it feels awkward. The invoice is delayed because nobody wants the argument. The client pays late. The founder shrugs and says, “They always do.”

Pattern

Client Exception Drift

A firm makes one exception for a valued client. Then it makes the same exception again because it feels easier than resetting the terms.

In small practices, one person can override the standard quickly. The override is rarely documented. The team learns that “the rules” depend on the client and who took the call.

This is not a pricing problem. It is a control problem. The firm has a standard process and a side door. Over time, the side door becomes the real process for the clients that matter most.

Analysis

The drift follows a predictable sequence.

1. Direct access. The client bypasses the team and goes to the founder. The founder responds fast to protect the relationship.

2. Vague instruction. Work is authorised without scope, fee position, or delivery constraints. Staff fill the gaps to keep pace.

3. Hidden subsidy. Time is under-recorded. Reviews are rushed. The firm absorbs rework and late changes because nobody wants to “make it commercial”.

4. Standards split. Other clients see slower turnaround because capacity is pulled into exceptions. Internally, staff become cynical about rules that can be ignored.

5. Cash and dispute risk. Invoices go out late, or go out high without written basis. The client pushes back. The founder negotiates it down. The team watches margin disappear and stops escalating next time.

At that point, the firm is training itself to lose money on the work it values most.

Framework: Assess → Align → Act

Assess

List the top ten clients by revenue. Mark the ones with “special handling”.

For each, capture three facts from the last 90 days:

Then write the exception types you see most: timing, scope, credit, or price.

Align

Agree a single rule: exceptions are allowed, but only with an explicit trade-off.

Set a short exception menu the founder can choose from in the moment:

Nominate who must be informed within 24 hours (usually the practice manager). No side deals.

Act

Introduce one written step: Client Exception Note.

Rule: if the founder grants an exception, the note is created the same day. It sits in the matter file. It triggers billing instructions.

Put one monthly review on the calendar: exceptions granted, margin impact, and whether the exception is still commercially sensible.

The goal is not to block the founder. It is to stop the firm paying for decisions it did not record.

Tool

Client Exception Note

If “what we are getting” cannot be written, it is not an exception. It is a loss leader by habit.

Why It Matters

Small practices do not have spare margin to fund informal discounts, rushed delivery, and late billing. Exception drift also damages internal discipline. Staff stop trusting standards and start managing by guesswork.

The commercial risk is simple: the clients you protect most become the clients who cost the most, and the firm cannot see it until cash tightens.

If this pattern is showing up in a practice you support, introduce them to The Unravelling Map™. Refer early. It keeps everything cleaner.